LiquidTrust Blog

Insights on payments, compliance, and building trust in digital marketplaces.

More Articles

When AI Starts Doing Trade: LiquidTrust™ & Authentica Team Up on the World’s First Autonomous Cross-Border Program

LiquidTrust™ & Authentica launch the world's first autonomous cross-border trade program. AI agents manage global transactions from sourcing to payment, secured by Micro Escrow™ and BioTag® verification. This innovation makes international trade faster, safer, and more efficient.

LiquidTrust™ Named to Datos Insights Fintech 50 for Real-Time Cross-Border Payments Innovation

LiquidTrust was named to Datos Insights’ Fintech 50 report as a leader in real-time cross-border payments innovation. Powered by Micro Escrow™, Protected Pay helps financial institutions offer secure, milestone-based B2B payments; reducing fraud, improving trust, and enabling SMB global growth.

Tariffs are Holding SMB Payments Hostage. Here’s How to Fix It.

In these uncertain times, surprise payments can suddenly mean the difference between keeping your business running or having to walk away. Protect your business transactions by using Micro Escrow Pay by LiquidTrust to ensure all parties in a transaction have equal leverage.

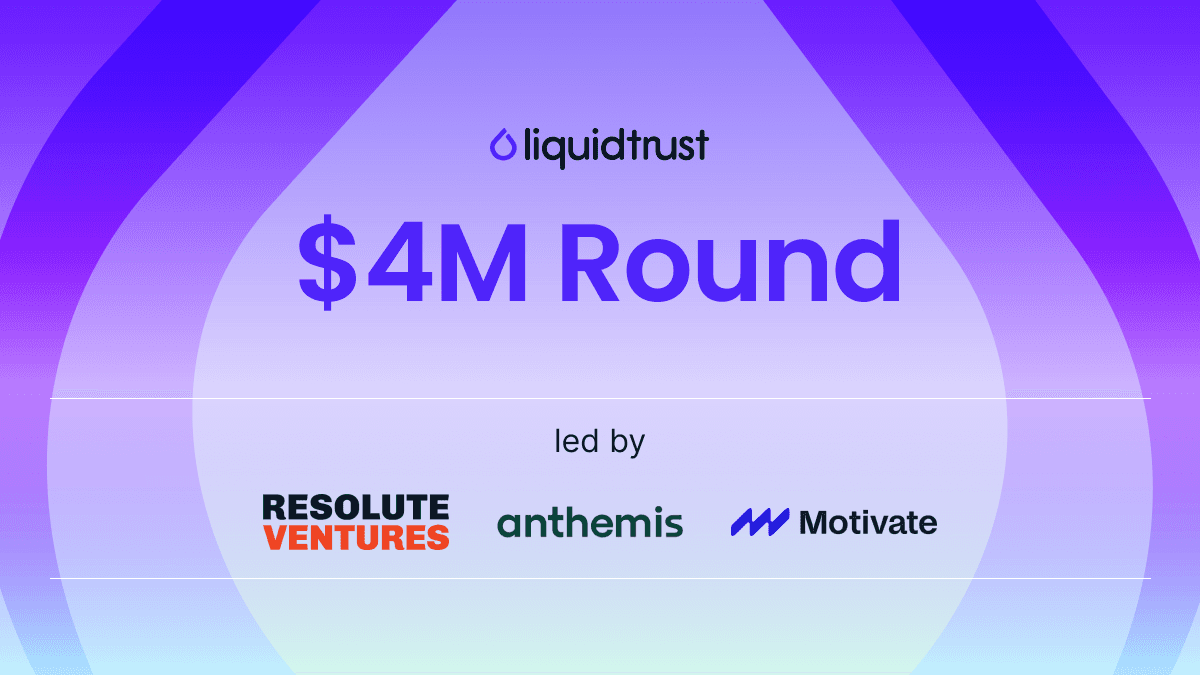

LiquidTrust™ Raises $4M Seed Round, Launches Micro Escrow™ Solution for Small Businesses

LiquidTrust announces $4M seed funding and launches Micro Escrow, a groundbreaking instant escrow solution protecting SMBs in global B2B transactions. Discover how LiquidTrust enables secure, fraud-free payments for small businesses worldwide.

A Double Win for Trusted SMB Payments: LiquidTrust™ at the Women in Payments Unicorn Challenge

LiquidTrust is the winner of the Women in Payments USA 2025 Unicorn Challenge. Discover how our innovative approach to SMB payments and our Micro Escrow™ technology are making global trade safer, leading to this recognition for fintech innovation from industry judges and peers.

What is Your Recourse for Non-Payment or Non-Delivery? Why an Escrow-Like Solution Offers Faster, Secure Collections

Small businesses have often shied away from working internationally due to the risks involved, as disputes or non-delivery are difficult to navigate across international borders. Using an escrow-like holding account can safeguard your project and expedite payment, protecting both parties.

Boosting Small Business Survival with Lower Costs: Why Secure International Payment Solutions Matter So Much

LiquidTrust enables small businesses to easily make global payments at a low cost, whether for direct payments or payments contingent on approval of work in an escrow-like holding account. Trust that your payment will arrive on time and intact with LiquidTrust.

The Benefits and Trust Risks of Global Expansion: Solutions for Navigating a Complex Landscape

Banking partners can help SMBs combat global expansion risks by providing guidance on global regulations and ensuring global payments arrive intact and on time. Help mitigate trust issues by using LiquidTrust to hold the funds on larger projects until the work is done.

Payment Protection Solutions: Why It’s A Banking Opportunity

Banks can grow their relationships with their SMB clients by providing payment protection solutions at a place they're already using. Find out what cutting-edge technologies you should be adopting to deepen your existing client relationships and gather more new clients.